HMRC

Advertisement

5M+

Installs

HM Revenue & Customs

Developer

-

Finance

Category

-

Rated for 3+

Content Rating

-

https://www.gov.uk/government/publications/data-protection-act-dpa-information-hm-revenue-and-customs-hold-about-you/data-protection-act-dpa-information-hm-revenue-and-customs-hold-about-you

Privacy Policy

Advertisement

Screenshots

editor reviews

The HMRC app, developed by Her Majesty’s Revenue & Customs, is a versatile and essential tool for UK taxpayers, providing easy access to various government services. It’s designed to streamline tax-related tasks, from checking your tax status to managing your self-assessment. As a frequent user myself, I can confidently say this app is a huge time-saver, especially with its ability to track and manage your payments, claim tax refunds, and communicate with HMRC without having to wait in long queues or navigate through lengthy phone calls. The simplicity of the app, paired with its robust security features, makes it a go-to for anyone dealing with taxes, benefits, or National Insurance issues. Having used it for filing my self-assessment and checking my National Insurance contributions, I’ve found that the app’s user-friendly interface and clear instructions make complex financial tasks much more manageable. What sets it apart from other apps in this category is its integration with other government services, allowing for a more seamless experience when handling multiple obligations. Whether you're checking your tax code, making payments, or setting up a payment plan, the app covers it all. So, if you’re looking to simplify your tax and financial administration, downloading the HMRC app is a must. With secure access and an array of helpful features, this app is your one-stop shop for managing all things tax-related. Don't wait—download it now and take control of your finances today!

features

- 📱 User-Friendly Interface Navigating the app is a breeze. The intuitive layout and straightforward menu make it incredibly easy for users to check their balances, submit forms, or track the status of their tax returns. Even if you’re not tech-savvy, the app provides clear instructions, helping you get tasks done efficiently.

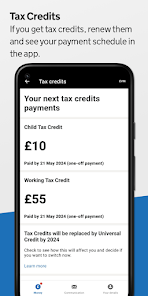

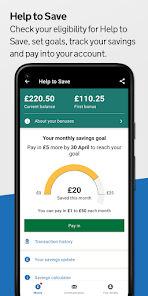

- 💼 Tax and National Insurance Management Whether you're checking your tax code or reviewing National Insurance contributions, this app offers a detailed breakdown of your tax information, allowing you to stay on top of payments and obligations. You can also access a history of payments, giving you a clear picture of your tax situation over time.

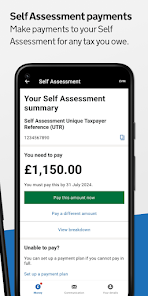

- 📅 Payment Management and Scheduling The HMRC app enables users to view upcoming payment deadlines and schedule payments directly from the app. This feature eliminates the risk of missing deadlines and incurring penalties, making it an essential tool for managing your finances on the go.

- 🔐 Secure Communication With its encrypted system, the app allows users to securely communicate with HMRC representatives for any queries or concerns. This feature ensures that your sensitive financial data remains protected while still enabling you to receive the assistance you need.

- 🚀 Fast Self-Assessment Filing For those who need to file a self-assessment, the app simplifies the process by guiding you through the necessary steps and automatically saving your progress. It’s a perfect solution for individuals who need to submit their annual tax return quickly and accurately.

pros

- 👍 Time-Saving Features The HMRC app’s streamlined functionality reduces the time spent on tax-related tasks. With instant access to your tax information, there’s no need to wait for paperwork or spend hours on the phone. Tasks that once took hours can now be done in minutes!

- 🔍 Comprehensive Coverage From checking your tax code to making payment arrangements or reviewing your self-assessment, the app covers all the essential services HMRC offers, making it your one-stop solution for managing taxes. It’s perfect for both individuals and businesses.

- 💳 Payment Convenience The ability to manage and pay taxes directly through the app is a huge advantage. It’s simple to make payments, set up instalments, and track your payment status—all in one place, with no need to visit the official HMRC website.

cons

- ⚠️ Limited to UK Taxpayers While the app is incredibly useful for UK residents, it’s not applicable to users outside of the UK. If you need tax services in another country, you’ll have to look for alternative apps.

- ⏳ Delayed Updates Sometimes, the app's information can be a bit slow to update, especially in relation to payment processing. This can cause confusion if you’re expecting immediate changes in your tax status.

- 💻 Requires Internet Access The app relies on a stable internet connection, which can be problematic in areas with poor service or if you're travelling abroad. Without a solid internet connection, the app may not function as intended, causing delays in accessing important information.

Advertisement

Recommended Apps

![]()

myID - Australian Government

Australian Taxation Office2.5![]()

Multiple Accounts: Dual Space

MA Team4.3![]()

AI Photo Editor, Collage-Fotor

AI Art Photo Editor | Everimaging Ltd.4.3![]()

Remote Mouse

Remote Mouse4.2![]()

MediBang Paint - Make Art !

MediBang Inc.4.3![]()

Formula 1®

Formula One Digital Media Limited4.1![]()

Monster Job Search

Monster Worldwide4.3![]()

V Shred: Diet & Fitness

V Shred3.9![]()

Jabra Sound+

Jabra by GN Audio4.6![]()

Used Cars

Escargot Studios, LLC4.5![]()

TikTok Studio

TikTok Pte. Ltd.4.5![]()

SweetRing - Meet, Match, Date

SweetRing3.4![]()

Cast for Chromecast & TV Cast

iKame Applications - Begamob Global4.1![]()

Yoti - your digital identity

Yoti4.2![]()

Heart Rate Plus: Pulse Monitor

PVDApps4.1

You May Like

-

![]()

DJ PADS - Become a DJ

Bilkon4.1 -

![]()

Holy Bible Offline

SOFTCRAFT4.6 -

![]()

imo live

Baby Penguin3.8 -

![]()

Bubble Level - Level Tool

Simple Design Ltd.4.8 -

![]()

TV Remote Control for Ruku TV

TV Cast4.6 -

![]()

Simple Fax-Send Fax from Phone

Easy inc.4.6 -

![]()

iTranslate Translator

iTranslate3.9 -

![]()

CashNetUSA

Enova International, Inc.4.3 -

![]()

Video Player

Smooth Video player and HD Movie player4.1 -

![]()

Pizza Pizza

Pizza Pizza Limited4 -

![]()

Arlo Secure: Home Security

Arlo Technologies, Inc3.5 -

![]()

Coupons.com: Earn Cash Back

Quotient Technology Inc. f/k/a Coupons.com Inc.4.1 -

![]()

FXNOW

Disney3.5 -

![]()

Step Counter EasyFit Pedometer

Herzberg Development4.6 -

![]()

Monefy - Budget & Expenses app

Reflective Technologies4.4

Disclaimer

1.Apponbest does not represent any developer, nor is it the developer of any App or game.

2.Apponbest provide custom reviews of Apps written by our own reviewers, and detailed information of these Apps, such as developer contacts, ratings and screenshots.

3.All trademarks, registered trademarks, product names and company names or logos appearing on the site are the property of their respective owners.

4. Apponbest abides by the federal Digital Millennium Copyright Act (DMCA) by responding to notices of alleged infringement that complies with the DMCA and other applicable laws.

5.If you are the owner or copyright representative and want to delete your information, please contact us [email protected].

6.All the information on this website is strictly observed all the terms and conditions of Google Ads Advertising policies and Google Unwanted Software policy .